What is Leverage?

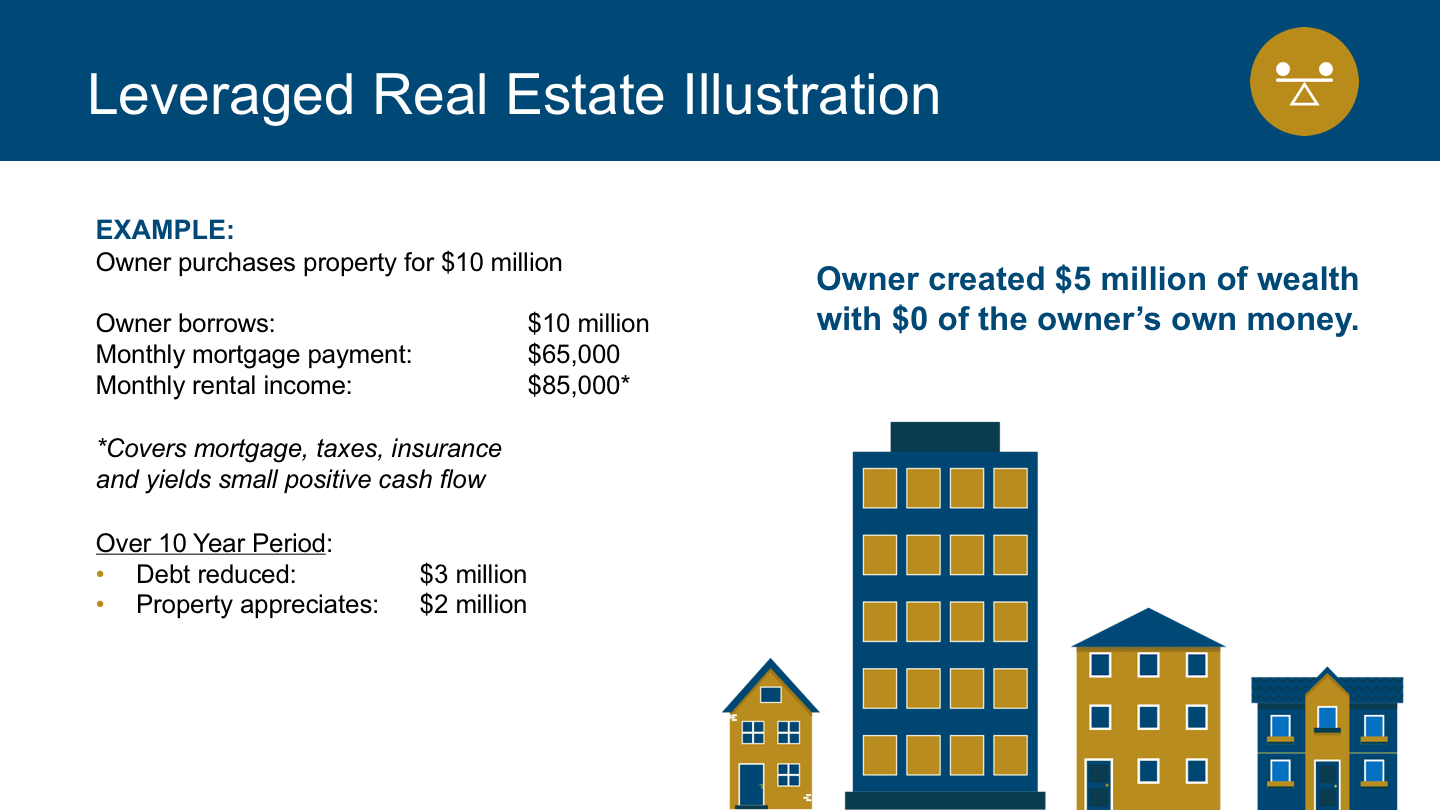

Leverage has been a financial strategy used exclusively by the ultra-wealthy. With leverage, capital is borrowed for an investment with the expectation that the return on investment will be greater than the cost of the loan.

EXAMPLES OF LEVERAGE

- Using a loan to buy a bigger house

- Purchasing an investment property to rent or flip

- Expanding a business using a loan without tying up cash flow

Put another way, you purchase items today using loans with the intention of out pacing the loan; e.g. the asset appreciates in value and eclipses the loan amount and interest.

This also allows clients to enjoy more wealth, sooner, and for a longer period of time. Most use leverage to expand a business, finance a bigger house, or purchase an investment property.

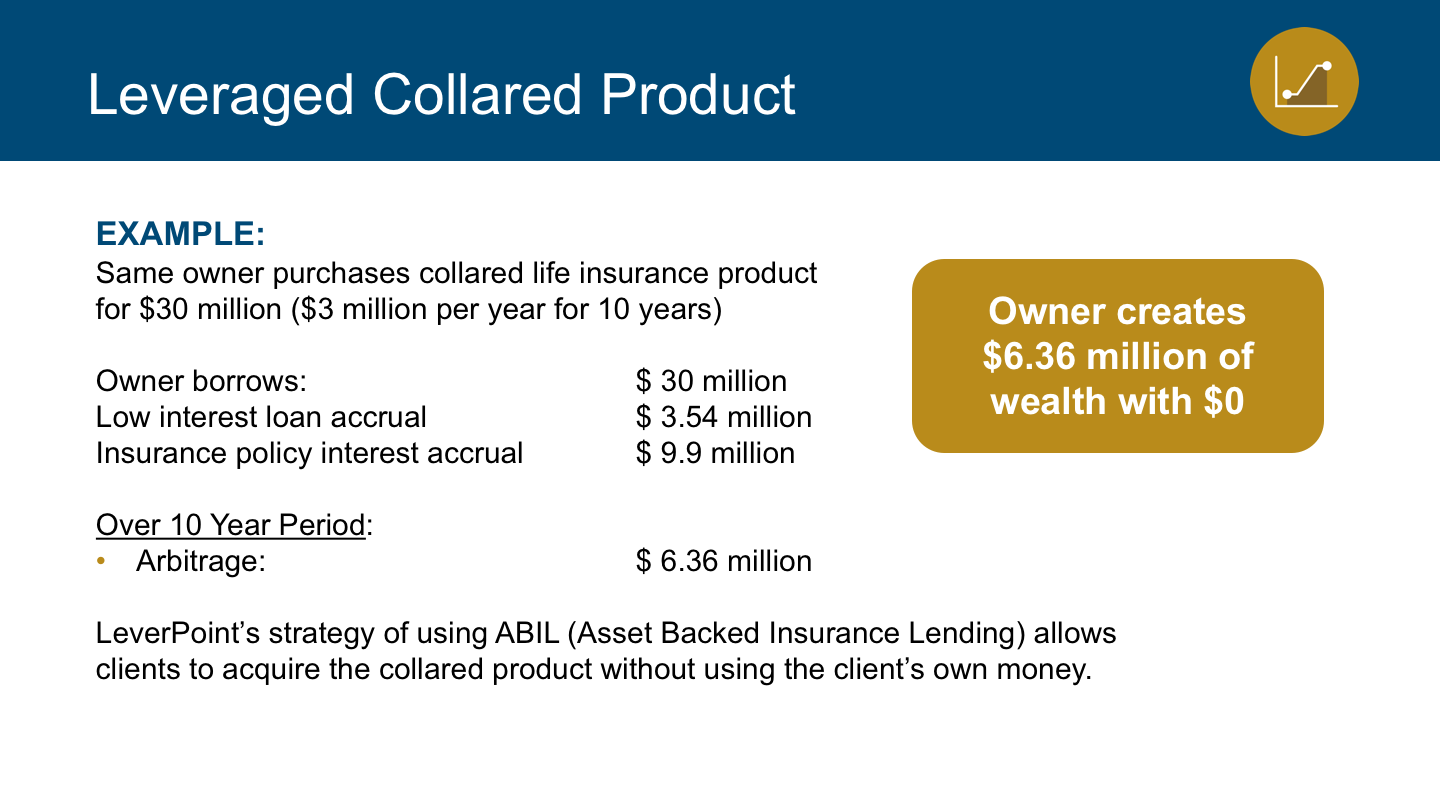

LeverPoint uses the same concept but it does so to maximize the purchase (and corresponding upside potential) of investment grade life insurance (a collared product).

Using leverage maximizes the growth potential in our clients’ life insurance policies so that they build and enjoy far more wealth and the peace of mind and enjoyment it affords. When designed correctly, cash accumulation in the life insurance policy eventually exceeds the cost of borrowing and has the potential to significantly exceed it.

The biggest challenge to this investment strategy is the risk involved with borrowing. That is why LeverPoint works to minimize risk across all platforms.

This means that our clients can enjoy all the added benefits of leverage without the added risk.